Understanding Transaction Anomalies

Transaction anomalies refer to irregular patterns or deviations from expected behavior within digital investment platforms. These irregularities can serve as early indicators of potential fraud or security threats. Anomaly detection encompasses a range of techniques used to identify these significant deviations from the norm. In the context of digital investments, anomaly detection is a critical component of fraud detection technology, as it proactively identifies unusual activities that could jeopardize the safety of assets.

Transaction anomalies can manifest across various platforms, including cryptocurrencies, stocks, non-fungible tokens (NFTs), and Forex. For instance, in cryptocurrency transactions, a sudden increase in the frequency of transactions involving a specific wallet could indicate a likelihood of fraudulent activity or money laundering. Similarly, an unexpected spike in sell orders for a particular stock may suggest coordinated efforts to manipulate the market. Recognizing these anomalies early is essential for effective digital investment monitoring.

Common patterns observed in fraudulent transactions include irregular transaction volume, geolocation disparities, and unusual buyer-seller profiles. For example, if a series of transactions originate from a geographic location that is atypical for a specific asset, this may warrant further investigation. The TAW platform leverages advanced fraud detection technology to analyze these behaviors, providing crypto transaction alerts and ensuring that any significant deviations are flagged promptly, allowing for necessary interventions.

By understanding transaction anomalies, investors can better safeguard their assets against potential threats. The implementation of robust anomaly detection methods across digital investment vehicles not only enhances security but also fosters a safer trading environment. Ultimately, mitigating risks associated with transaction anomalies is imperative for protecting investments in today’s increasingly volatile market landscape.

The Role of Anomaly Detection Technology

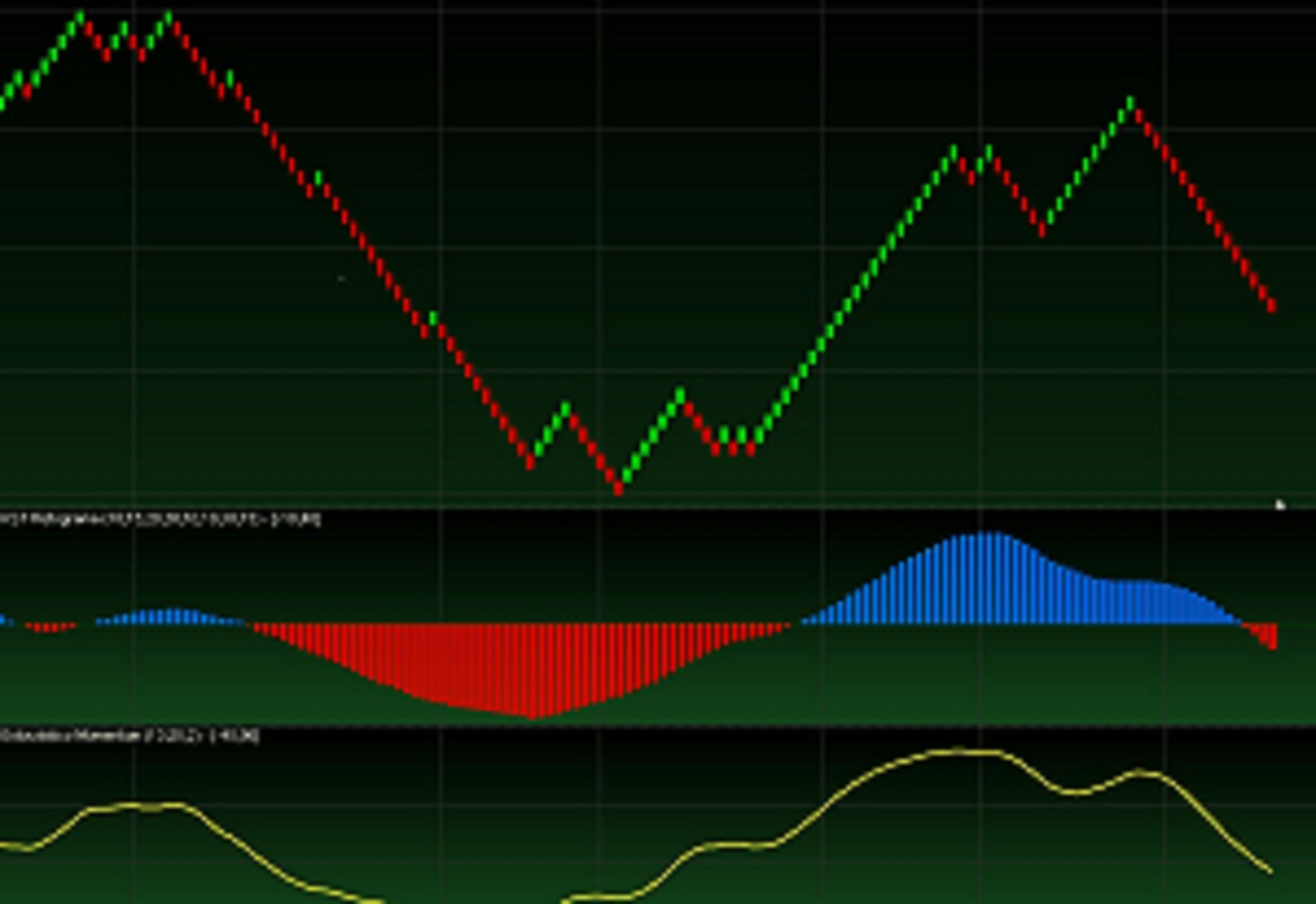

In the realm of digital investment security, transaction anomaly watch plays a pivotal role in safeguarding assets against potential fraud. Anomaly detection technology harnesses the power of machine learning and artificial intelligence (AI) to scrutinize extensive streams of transaction data in real-time. This advanced technological framework is refined endlessly to ensure that it can swiftly identify suspicious patterns that deviate from established norms.

At the core of these systems are sophisticated algorithms designed to differentiate between normal transactions and those that exhibit anomalies. These algorithms utilize various techniques such as clustering, classification, and neural networks to assess transactional behavior comprehensively. For instance, clustering algorithms group typical transaction patterns, enabling the system to quickly recognize any outlier that falls outside of these established clusters, indicating a potential issue.

Furthermore, AI models, once trained on extensive datasets, gain the capability to adapt and evolve continually. This feature is particularly crucial in the dynamic landscape of digital investment monitoring, where fraudsters often shift tactics and techniques. By utilizing predictive analytics, the system can provide crypto transaction alerts that notify users about unusual activity, allowing for timely intervention and minimizing losses.

The importance of early detection in the context of fraud detection technology cannot be overstated. Identifying anomalies in transactions at the earliest possible moment equips investors and financial institutions with the necessary tools to mitigate risks effectively. The incorporation of platforms like the taw platform enhances this capability, enabling a more sophisticated layer of security across various digital investment avenues. Ultimately, the role of anomaly detection technology is indispensable in enhancing the integrity and security of digital transactions.

Implementing Transaction Anomaly Detection Solutions

In the rapidly evolving landscape of digital investments, the integration of transaction anomaly detection solutions has become vital for ensuring security and integrity. Numerous platforms, such as the TAW platform, leverage fraud detection technology to monitor financial activities in real-time. These technologies can identify unusual transaction patterns, flagging potential fraud before any harm occurs.

The implementation process typically begins with an assessment of existing financial systems. Businesses must evaluate their specific needs and determine how anomaly detection solutions can complement their current infrastructure. After selection, integration follows, which may involve using APIs to connect the transaction anomaly watch tools with legacy systems. This integration allows for streamlined data flow and enhances the overall effectiveness of monitoring capabilities.

Once integrated, the focus shifts to establishing a robust monitoring and alerting framework. This framework is crucial for providing timely notifications on suspicious activities, thus enabling swift response actions. Organizations can configure alerts based on defined thresholds, ensuring they remain informed of potential risks in real-time. To optimize the system further, continuous tuning of the fraud detection models is essential, adapting them to new data and emerging threats in the investment landscape.

Best practices for digital investment monitoring include ongoing training for staff on how to interpret alerts and respond effectively. Evaluation of the implemented solutions should also be conducted regularly to ensure they adapt to increasingly sophisticated fraudulent tactics. By continuously refining their approach and leveraging advanced tools in their transaction anomaly detection strategy, businesses can significantly enhance their protective measures against fraud.

The Future of Digital Investment Security

The landscape of digital investment is evolving rapidly, marked by the increasing complexity and variety of digital currencies. As more individuals and institutions begin to engage with cryptocurrencies and blockchain technologies, the importance of effective transaction anomaly watch mechanisms becomes more pronounced. Digital currencies, while offering innovative investment opportunities, also introduce unique risks such as market manipulation and fraud, necessitating robust fraud detection technology to protect stakeholders.

Advancements in anomaly detection technology are expected to play a crucial role in the future of digital investment security. Machine learning algorithms and artificial intelligence are at the forefront of this evolution, allowing for real-time monitoring and analysis of vast amounts of transaction data. As these technologies continue to improve, the accuracy and effectiveness of crypto transaction alerts will enhance, enabling stakeholders to identify and respond to suspicious activities more efficiently. This proactive approach will be instrumental in not only protecting investments but also in instilling greater confidence in digital financial systems.

Furthermore, regulatory changes are likely to have a significant impact on fraud detection practices within the digital investment space. As governments and regulatory bodies enhance their frameworks for cryptocurrency oversight, compliance requirements may shift, influencing how investment platforms implement their transaction anomaly watch systems. Keeping pace with these regulatory trends will be essential for platforms to safeguard investments and meet compliance standards simultaneously.

In conclusion, as we look to the future, it is evident that the integration of advanced technology in transaction anomaly detection, coupled with responsive regulatory frameworks, will foster a more secure environment for digital investments. Stakeholders must actively engage with emerging solutions in fraud detection technology to protect their assets effectively in this rapidly changing landscape.