Understanding the Immediate Impact of Scam Victimization

The experience of falling victim to a scam can have profound psychological and financial repercussions on individuals. Victims often encounter a whirlwind of emotions, including fear, confusion, and anger. These feelings can arise from the sudden realization that trust has been exploited and personal security is compromised. This mental turmoil can affect decision-making abilities and hinder the victim’s capacity to pursue effective after scam recovery steps.

Financially, scams can lead to significant losses, often leaving victims scrambling to assess the damage. It is crucial for individuals to understand the urgency of taking swift actions to mitigate any potential further losses. Engaging in a taw recovery guide is a vital first step in this journey. This guide not only offers support but also serves as a roadmap to navigate the complex processes involved in recovering lost funds.

Moreover, acknowledging and addressing the emotional impact of being scammed is equally important. Victims may experience heightened anxiety, a sense of violation, and in some cases, post-traumatic stress-like symptoms. It is essential to validate these feelings and seek appropriate support. This can include reaching out to trusted friends, family members, or professional counselors who can provide guidance during this challenging time.

In essence, understanding the immediate impact of scam victimization allows individuals to recognize that they are not alone in their experiences. It highlights the importance of taking immediate actions through structured recovery guides and emotional support, which are integral in reclaiming not only financial stability but also mental well-being in the aftermath of such distressing events.

Collecting Evidence: The Key to Strengthening Your Case

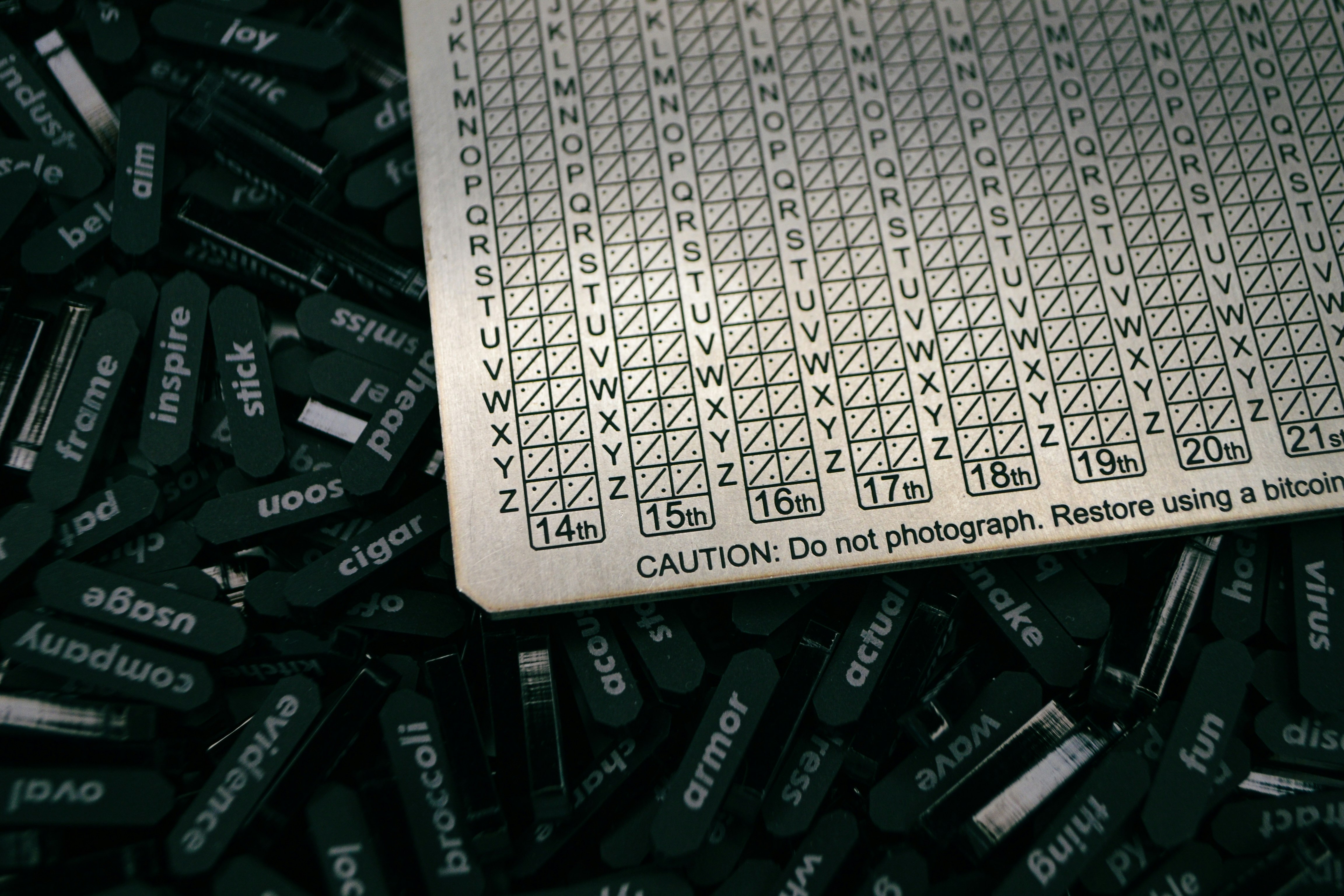

After experiencing a scam, the priority is to collect robust evidence that can support your case and facilitate recovery efforts. The initial step involves documenting all financial transactions related to the scam. This includes gathering bank statements, transaction records, receipts, and any other financial documents. Accurate documentation is vital in building a taw recovery guide, as it provides concrete proof of the scam activities.

Furthermore, you should meticulously collect all communications with the scammer, whether through email, text messages, or social media. These communications can offer insights into the scammer’s tactics and intentions, which will be significant when presenting your case to law enforcement or reporting agencies. It is important to take screenshots or save these messages in a format that preserves their authenticity.

In addition to collecting textual evidence, record any verbal interactions. If you spoke to the scammer over the phone, note the date, time, and content of the conversation. Such details can help authorities understand the context of the scam better.

Moreover, utilizing asset tracing tools can be effective in tracking down misappropriated funds. These tools enable you to monitor financial transactions across different platforms, increasing the likelihood of recovering lost assets. By employing these resources, you can strengthen your claim and build a more persuasive case.

Overall, the evidence collected in this phase plays a crucial role in combating transactions anomaly watch efforts, ensuring that the appropriate authorities have access to everything they need to investigate the scam thoroughly. A thorough collection of evidence not only aids in recovery but also contributes to preventing further scams by holding perpetrators accountable.

Engaging Transaction Anomaly Watch (TAW): How to Report the Scam Effectively

When victims of scams find themselves navigating the aftermath, engaging with the Transaction Anomaly Watch (TAW) can be a pivotal step in their recovery. The process begins with a clear understanding of how to report the scam effectively. Establishing a structured and organized presentation of your case to TAW increases the likelihood of a successful outcome.

The first crucial element is gathering relevant information pertaining to the scam. This may include details such as the nature of the scam, the timeline of events, and any financial transactions that were affected. Documentation such as emails, screenshots, and transaction records should be compiled to create a comprehensive overview of the situation. The more detailed the report, the easier it is for TAW to assess the incident accurately.

After gathering the necessary information, scammers can submit their report through TAW’s designated channels. It is essential to follow any specific guidelines TAW provides about the format and content required for reporting. While at times might feel overwhelming, this structure not only keeps the report concise and to the point but also supports claim validation.

Once the submission is made, setting follow-up reminders can be beneficial. Keeping track of correspondence with TAW helps in maintaining engagement and addressing any requests for additional information promptly. TAW may also offer resources aimed specifically at aiding recovery after a scam, which can enhance the success of your recovery efforts.

In engaged collaboration with Transaction Anomaly Watch, victims can take significant strides towards understanding their situation better and outlining effective recovery paths, forming an integral part of the overall taw recovery guide following scam incidents.

Developing a Long-Term Recovery Strategy After Losing Assets

Recovering from a scam that has resulted in asset loss is a challenging yet essential process. Establishing a long-term recovery strategy can help ensure that victims not only bounce back financially but also feel equipped to prevent future occurrences. An effective taw recovery guide emphasizes the importance of taking comprehensive steps after the immediate aftermath of a scam.

One of the first steps in developing a long-term recovery plan is to engage with support groups. These groups often consist of individuals with similar experiences who understand the emotional and psychological toll such events can take. Engaging with others can foster resilience and provide a platform for sharing recovery strategies. Primary goals can include building a sense of community and finding validation through shared experiences.

Additionally, seeking professional advice from financial counselors or legal experts is crucial. Specialized advisors can provide insights into the complexities surrounding transaction anomaly watches, helping you understand the nuances of recovering assets and dealing with financial institutions. They may also assist in navigating legal options that could be pursued against the perpetrators of the scam, ensuring that victims are aware of their rights and the possible recourses available.

Furthermore, continued education on potential scams and responsible investing plays a vital role in a recovery strategy. By participating in workshops and online courses, individuals can develop their skills in identifying scams early on. This knowledge not only aids in personal recovery but also helps in safeguarding against future financial fraud. Victims are encouraged to familiarize themselves with common scam trends to enhance their vigilance. Building a proactive approach to financial literacy ensures individuals are better prepared when engaging in transactions.

In conclusion, the path to recovery after losing assets due to a scam requires a multifaceted approach that combines emotional support, professional advice, and ongoing education. By implementing these strategies, victims can not only recover but also foster a sense of empowerment and security in their financial decisions moving forward.